How many employees does Amazon have?

Amazon reports about 1,556,000 total full‑time and part‑time workers worldwide. This figure covers both corporate and tech staff and the far larger group in warehouses, fulfillment centers, and transportation.

The split shows roughly 350,000 in corporate and technical roles and the rest on the front lines of delivery and logistics. Seasonal hiring lifts numbers during peak shopping seasons, adding hundreds of thousands more temporary staff.

The headcount moves with business needs. Recently, the company announced plans to cut about 14,000 corporate roles as it invests in generative intelligence and flattens layers for faster decision making. Prior reductions since 2022 totaled about 27,000, even as seasonal hiring rose.

Readers should view this as a snapshot: hiring continues in strategic areas even as teams shrink elsewhere. The scale means small percentage shifts equal large job changes, which matters for the broader workforce picture.

How many employees does Amazon have today?

At the latest checkpoint, the company lists about 1,556,000 people worldwide. That figure comes from the most recent annual report and aligns with the prior quarter, which showed more than 1.54 million at the end of Q2.

Global headcount at the latest checkpoint

The total breaks into roughly 350,000 in corporate and tech roles and the much larger group in fulfillment, transportation, and operations.

Corporate and tech vs. warehouse and operations

Amazon has announced a plan to cut about 14,000 corporate positions as it flattens layers and reinvests in AI. That change equals roughly four percent of corporate employees, not the entire base.

- Seasonal hiring can lift totals: the company planned to add 250,000 workers for the holiday period.

- Affected people get a 90-day internal search window, with recruiters prioritizing internal moves.

- Strategic hiring continues in AI, cloud, and logistics even as some office roles are reduced.

“This snapshot shows where headcount stands today and why totals can shift with seasonal demand.”

AI, job cuts, and a leaner organization: what’s changing inside Amazon

Leadership says the company is reshaping office teams to free resources for major bets in generative artificial intelligence. The shift aims to speed decision making with fewer layers and more ownership.

“Most transformative since the internet”: Amazon’s AI push and biggest bets

Beth Galetti called generative AI the “most transformative technology we’ve seen since the Internet.” That framing justifies moving money and people toward AI work and other top biggest bets.

About 14,000 corporate employees affected as fewer layers and more ownership take hold

The company announced roughly 14,000 corporate job cuts to remove redundant layers and fund AI. Impacted units include cloud, grocery, video games, HR, sustainability, ads, and devices.

Which business units are impacted and where hiring continues

Reductions touch many teams, yet hiring continues in core AI, cloud, and infrastructure roles. The goal is to let teams move quickly possible for customers while trimming bureaucracy.

Leadership signals from Andy Jassy on roles that will grow and shrink

Andy Jassy warned that some roles will shrink as automation and intelligence scale, while other jobs will expand. Affected workers get a 90-day internal window to seek new roles and must follow hub-based office expectations.

- Why cuts: fund AI and boost speed.

- Where: many corporate units; priority hiring in tech and cloud.

- Support: internal mobility and transition time for workers.

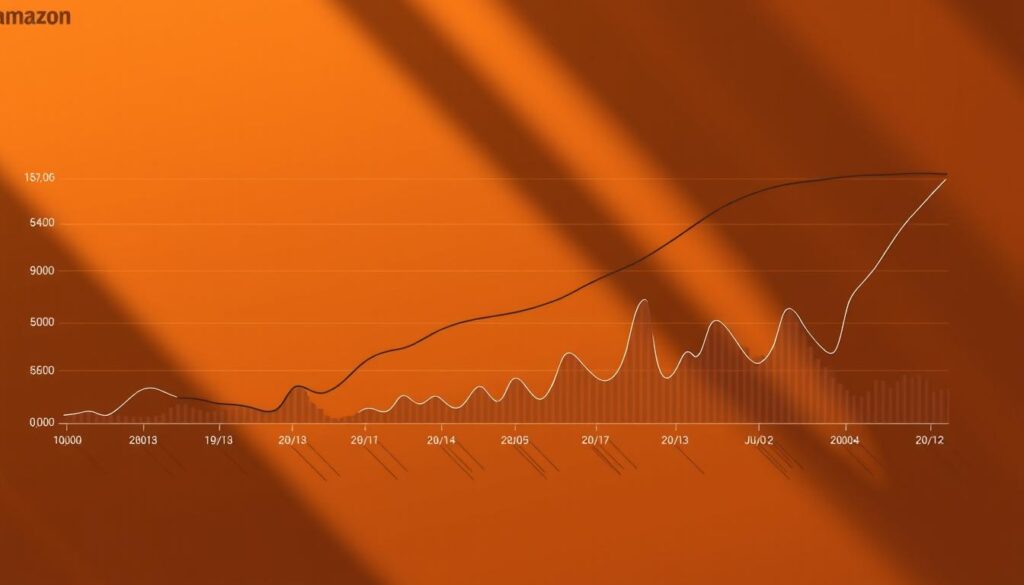

Workforce trends over time: growth spurts, pullbacks, and quarterly shifts

Over two decades the headcount rose from a modest base to a global workforce measured in the millions. That long arc shows steady hiring in retail and logistics, plus waves tied to cloud and devices.

From 17,000 in 2007 to roughly 1.55 million+

Headcounts climbed from about 17,000 in 2007 to ~1,556,000 in 2025—more than a 90x increase. Annual totals highlight steady growth: 2017 (566,000), 2018 (647,500), 2019 (798,000).

Pandemic surge and normalization

The pandemic caused the biggest jumps: 2020 topped 1.29 million and 2021 peaked at 1.608 million. Quarterly spikes in 2020 and late 2021 reflect urgent demand for delivery and cloud capacity.

Quarterly shifts and demographic snapshot

Largest quarterly rises occurred Q2→Q3 2020 (+248,500) and Q3→Q4 2020 (+172,700). After 2021 the company trimmed some roles and then stabilized into 2024 before modest growth returned.

- Gender: ~56.8% male, 43.1% female (global, 2022).

- Ethnicity (2022): White 31.9%, Black 26.1%, LatinX 23.5%, Asian 16.6%.

- Age: 54% are 20–30, only 17% over 40.

“Shifts reflect seasonal demand, tech investments, and targeted cuts to fund new priorities.”

What the numbers mean for Amazon’s workforce in the near term

What the numbers mean for the workforce in the near term

The company will likely run a leaner corporate structure while operations remain flexible for seasonal demand. Leadership expects generative AI to trim overlapping layers and shift roles toward AI, cloud, and platform work.

Hiring will continue where mission-critical capabilities matter. Around 14,000 corporate reductions and internal redeployment windows mean many people will face a year of transition and reskilling.

In practice, resources will target AI and cloud, logistics hiring will rise at peak times, and ownership-focused teams should move quickly possible to serve quickly possible customers.