How Much Is Amazon Prime With Tax in 2023?

Amazon Prime is a popular subscription-based service offered by the e-commerce giant Amazon. It provides a range of benefits to its members, including free and fast shipping on eligible items, access to Prime Video streaming service, unlimited access to Prime Music, and much more. Many users wonder about the cost of Amazon Prime, including any applicable taxes, in the year 2023. In this article, we will provide an overview of Amazon Prime, its pricing structure, and whether taxes are included in the membership fees.

What is Amazon Prime?

Amazon Prime is a subscription service offered by Amazon, one of the largest online retailers in the world. It provides subscribers with a variety of benefits, including free and fast shipping on eligible items, access to exclusive deals and discounts, unlimited streaming of movies, TV shows, music, and much more. Amazon Prime is available to customers in over 20 countries and has millions of members worldwide.

Amazon Prime Membership Pricing

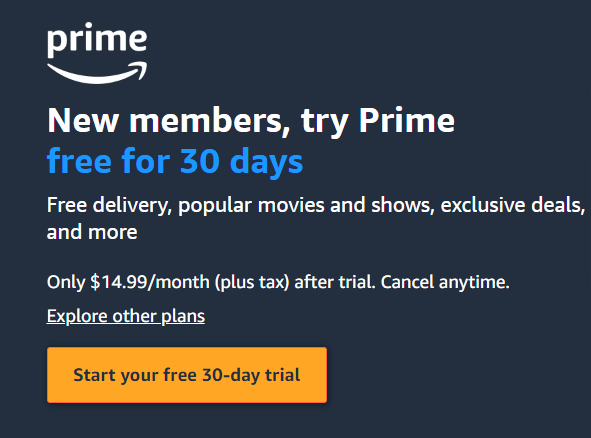

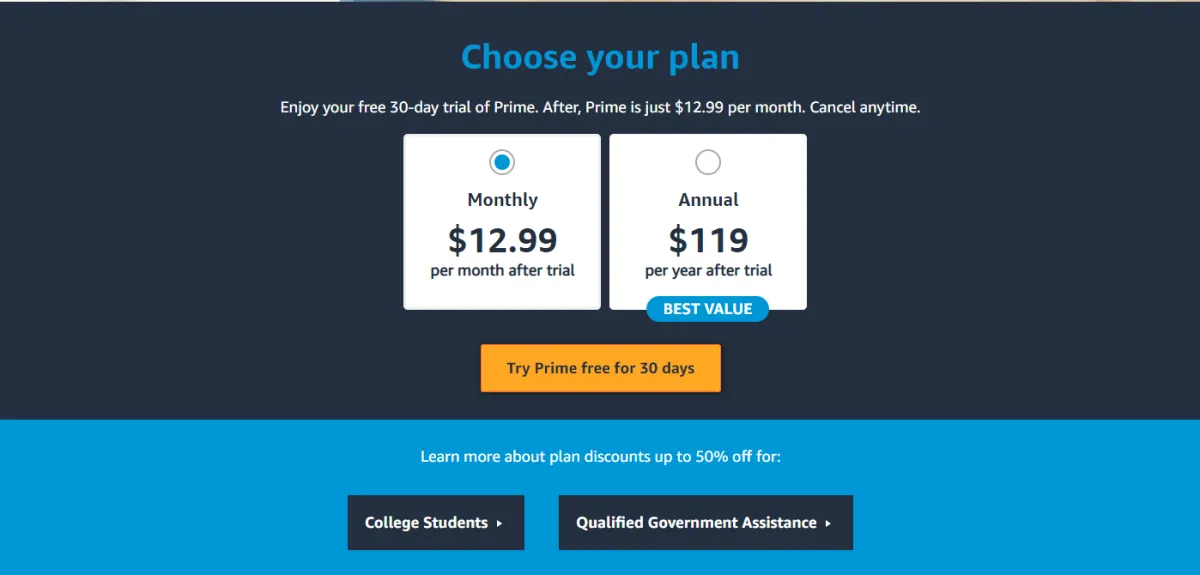

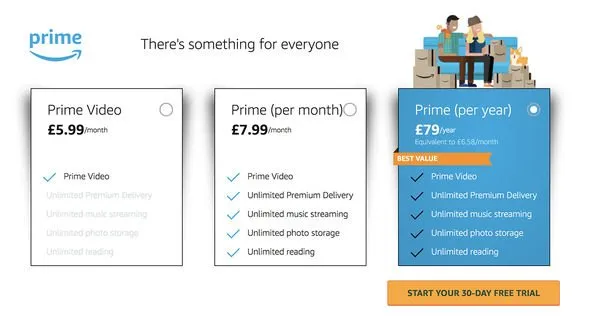

Amazon Prime offers different membership options, including monthly and annual plans, each with its own pricing structure. As of 2023, the monthly membership fee for Amazon Prime is $12.99, while the annual membership fee is $119.00. These prices are exclusive of taxes and may vary depending on your location. It’s important to note that Amazon Prime membership fees are subject to change, and it’s always best to verify the most up-to-date pricing on the Amazon website or app.

Tax Considerations for Amazon Prime

When it comes to taxes, Amazon Prime membership fees are generally subject to sales tax in most states in the United States. The exact amount of tax applied to Amazon Prime membership fees may vary depending on the state and local tax rates applicable in your location. It’s essential to be aware of the tax implications associated with Amazon Prime membership fees and factor them into your budget when considering the total cost of your subscription.

Calculating Amazon Prime Membership Price with Tax

To calculate the total cost of Amazon Prime with tax in 2023, you would need to consider the applicable sales tax rate in your location. Sales tax rates can vary from state to state and even within local jurisdictions, so it’s crucial to check the current tax rates in your area. Once you have the sales tax rate, you can multiply it by the Amazon Prime membership fee (monthly or annual) to determine the total cost with tax. For example, if the sales tax rate in your location is 7% and you have a monthly Amazon Prime membership, the total cost with tax would be $13.90 ($12.99 + 7% tax).

Additional Fees and Charges

In addition to the membership fee and sales tax, it’s important to be aware of any additional fees or charges that may apply to your Amazon Prime subscription. For example, if you choose to add additional services or features, such as Amazon Prime Video Channels or Amazon Prime Pantry, there may be additional fees associated with those services. It’s essential to review the terms and conditions of your Amazon Prime membership to understand any additional charges that may apply.

Ways to Save on Amazon Prime Membership

While Amazon Prime offers a wide range of benefits, the total cost, including taxes, can add up. However, there are ways to save on your Amazon Prime membership fees. For example, opting for the annual membership plan instead of the monthly plan can result in significant savings, as the annual plan offers a discounted rate compared to the monthly plan. Additionally, Amazon occasionally offers promotions, discounts, or special deals on Prime membership fees, so it’s worth keeping an eye out for any cost-saving opportunities.

CONCLUSION :

In conclusion, Amazon Prime is a popular subscription service that offers numerous benefits to its members. When considering the cost of Amazon Prime, it’s important to account for the membership fee, sales tax, and any additional fees or charges that may apply. By understanding the pricing structure and tax implications of Amazon Prime membership, you can make informed decisions